The advent of the BCR::ABL1 tyrosine kinase inhibitors for the treatment of Philadelphia chromosome (Ph)-positive chronic myeloid leukemia (CML) was a therapeutic miracle that changed the management paradigm of CML. The first of them, imatinib, was developed in the late 1990s.1,2 Within a few years, front-line CML therapy transformed from interferon-alpha and allogeneic stem cell transplantation to tyrosine kinase inhibitors and, with them, the near normalization of life expectancy.1,2

Hagop Kantarjian, MD

Mary Alma Welch, MMSc

Today, front-line therapy for CML may be with any of the four tyrosine kinase inhibitors approved by the U.S. Food and Drug Administration (FDA) for the indication: imatinib, dasatinib, nilotinib, or bosutinib. They result in similar survival benefits when patients are treated and monitored optimally, as well as when salvage therapy is promptly implemented as required for disease resistance or side effects. Choosing the best salvage therapy depends on several factors: the tyrosine kinase inhibitor used as front-line therapy; whether failure is because of resistance or toxicities; patient comorbidities; the presence of ABL1 kinase domain mutations; and the price of the tyrosine kinase inhibitor. Furthermore, along with the four front-line options, two third-gen-eration tyrosine kinase inhibitors—ponatinib and asciminib—are available and are active against ABL1 T315I–mutated CML.1,2

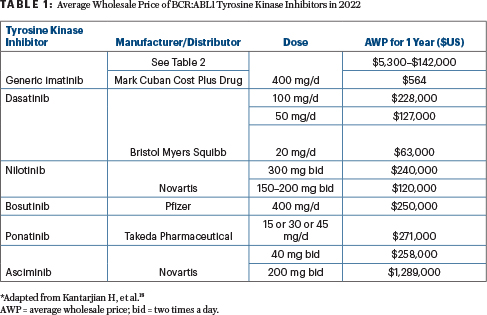

In addition to survival normalization, a second therapeutic endpoint in CML is the achievement of a “treatment-free remission” status, defined as a durable, deep molecular response that is maintained for 2 to 5+ years. A durable deep molecular response of more than 2 years is associated with a 50% treatment-free remission rate after tyrosine kinase inhibitor discontinuation, whereas a durable deep molecular response of more than 5 years produces an 80+% rate.3,4 This endpoint has justified the potential use of the more expensive second-generation tyrosine kinase inhibitors as front-line CML therapy (Table 1).

The management of CML is critically reviewed as new data emerge about the long-term efficacy, side effects, and cost of tyrosine kinase inhibitors. Cost considerations and the associated treatment value depend on the patient age and goal of therapy (ie, survival, treatment-free remission).

How Generic Tyrosine Kinase Inhibitors May Influence CML Treatment Pathways

The first BCR::ABL1 tyrosine kinase inhibitor, imatinib (Gleevec in the United States), was approved for the treatment of CML in 2001. The launch price justified by the price of interferon-alpha (the previous standard of care) was $32,000/year .4-11 This price for a targeted oncology agent was the trigger event for justifying the escalating prices of all new cancer drugs. By 2012, the imatinib price had increased to more than $100,000/year, with no correlation to the cost of research and development, population size, or market forces. It was simply based on market exclusivity and maximizing profits, even though this meant the drug was unaffordable to a large segment of patients.

This scenario has become the norm for all cancer drugs and has provoked questions about the affordability and availability of cancer drugs, their penetration in patient subsets, the out-of-pocket expenses (increased to 25% recently), and the health-care injustice associated with such practices. Among financially vulnerable patients (less wealthy; insured but with high out-of-pocket expenses; uninsured), these practices rendered them realistically “uninsured.”4-11 Today, the launch price of new targeted cancer drugs exceeds $150,000 to 200,000/year. These issues have been detailed in previous publications.8-14

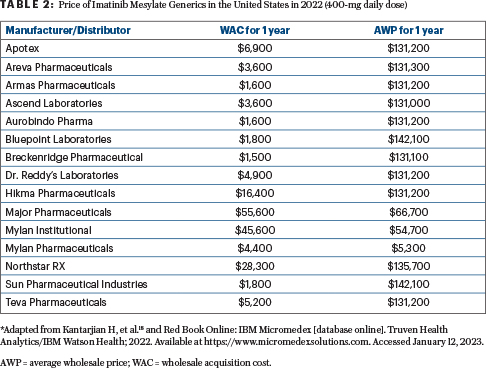

The first generic imatinib became available in the United States in 2017. Sadly, this still did not reduce the price because of multiple maneuvers available to drug companies (delays in the availability of low-cost generics beyond patent expirations; discussed elsewhere).9 The conventional wisdom is that, based on market forces, the price of a generic drug drops significantly once four to five formulations become available. This is true for the drug prices when they leave manufacturers’ doors and is reflected in the wholesale acquisition cost, as shown in Table 2 (wholesale acquisition cost of $1,500–$55,600 per year, but low-cost selections are available). However, this is not the price charged to patients (or their insurance companies) once the drug is prescribed. That price is the average wholesale price, which, astoundingly in the case of imatinib, remained in many cases more than $130,000 per year, despite the availability of 15 generics (Table 2).

For example, the wholesale acquisition cost of one generic imatinib (Apotex) is $6,900 per year, but the average wholesale price is $131,200. In contrast, the wholesale acquisition cost of Mylan Pharmaceuticals’ product is $4,400 per year, and the average wholesale price is $5,300. This anomaly is not the fault of manufacturers but of intermediaries (discussed later) and is unfortunately one facet of the dysfunctional health-care and drug-pricing systems in the United States.12-17 One might assume that, knowing the variation in prices, patients could shop around. However, this frequently is not the case, because many patients are overwhelmed managing their disease and lives, moving from one medical or financial crisis to another, and may not be knowledgeable enough to navigate the complicated system. Moreover, they could be directed by their insurance companies to obtain drugs in specialty outlets or hospital pharmacies, which purchase drugs in a “bundling” approach that may not offer the most affordable option.

This begs the question of who are these “intermediaries” distorting the prices, leading to potential harm to patients with cancer?

From Manufacturer to Patient: The Tortuous Journey of a Drug Price

Here, a primer is needed to explain the convoluted journey of a drug and its price from the manufacturer to the patient.18 The price of a patented drug is set by the manufacturers, thus assigning to them culpability for the exorbitant costs of new cancer medications (discussed previously in several publications).4-11 This is not the case for generics. In this situation, the issue is the intermediaries between the manufacturer and the patient.

Once a drug is manufactured and leaves the doors of the drug company, it starts a complex supply chain path that allows different players to set prices to increase their profits. The intermediaries include wholesalers (the top three in the United States are Amerisource Bergen, McKesson, Cardinal Health) who acquire drugs from manufacturers (wholesale acquisition cost), pharmacies, or hospitals who acquire drugs from wholesalers (average wholesale price), often in contracts that include multiple drugs and not necessarily the lowest-priced generic options. Pharmacies and hospitals are usually part of a group purchasing organization, which buys drugs at a lower cost than the listed average wholesale price (group purchasing organization price); this increases their profits, but that price reduction may not ultimately be passed on to patients.

Another intermediary is the pharmacy benefit manager, who controls which medications are included on insurance company formularies. The pharmacy benefit managers negotiate drug prices directly with the manufacturers and maximize their leverage on this formulary decision. They also obtain significant rebates, which are not fully passed on to insurers or patients. The end of the generic drug journey to the patient reflects a multifold price bubble that benefits all the intermediaries, but not the patients (Table 2).

This not-so-helpful journey is often bypassed in other countries. For instance, in Europe and elsewhere, governments often contract with manufacturers directly and negotiate the drug price based on its added therapeutic value, external reference pricing, and budget caps to control the national health insurance drug spending (discussed elsewhere).18 There are also established processes that limit patients’ financial burden due to high out-of-pocket costs, a common reason for abandoning care and patient bankruptcies in the United States.

The ‘Marc Cuban’ Drug Pricing Model

So, how do we solve this dilemma? The solution may exist in the form of the novel experiment launched in 2021 by billionaire Mark Cuban, a model that should be applauded, nurtured, and expanded.18

Mr. Cuban created an online generic company, CostPlus; it bypasses the intermediaries and offers a limited number of generic drugs directly to patients (with a physician prescription) at the manufacturer’s cost plus 15%. The obvious aim is to better reflect market forces and help patients by offering lower drug prices while still making reasonable profits.

Among the drugs is generic imatinib for CML, priced at $47/month for 400-mg tablets, making the annual price $564 instead of $130,000+. This is affordable to almost any patient in the United States, with or without insurance, and, in fact, the cash price may be less than what would be spent on co-pays charged by insurance. In addition to being a good business plan for Mr. Cuban, it is an important humanitarian gesture that will save many lives, particularly if the model flourishes.

The CostPlus concept is not unique. Civica Rx, Scriptco Pharmacy, Honeybee, Genius Rx, and Ro Pharmacy (and hopefully soon many others) have similar structures and goals—to help deliver generic drugs to patients at significantly lower prices.18

Associated Problems and Solutions

The downsides of CostPlus and similar companies, which are still significant, are listed here:

- Most drugs offered are for chronic conditions and only as generics.

- The cancer drugs offered are limited.

- Patients with cancer are often on multiple medications and may have to obtain drugs from different pharmacies, which complicates the process significantly.

- These companies do not bill insurers, and patients must pay directly for the prescriptions, thereby not contributing to their deductibles.18

These issues will hopefully be resolved over time as this model matures, providing the desirable combination of good business and sustainable profits. These companies may then expand to offer a much larger menu of drugs (including cancer medications), initiate processes to offer patented formulations at lower prices, and agree to bill the insurers.

Closing Thoughts

High cancer drug prices are a persistent and increasing problem in the United States. Harmed are millions of vulnerable families and patients, who cannot afford needed drugs, abandon care, declare bankruptcy, and are helped or cured at significantly lower rates than wealthier patients. This health-care injustice in the United States may be remedied over time by strategies and legislations that offer expanded medical safety nets and universal health care. However, this new pricing model for generic drugs may serve as a catalyst to begin to make access to cancer medications more equal, and in the process save millions of lives in the next decade(s).

DISCLOSURE: Dr. Kantarjian has received research grants and/or honoraria from AbbVie, Amgen, Ascentage, BMS, Daiichi Sankyo, Immunogen, Jazz, Novartis, Pfizer, Sanofi, Adaptive Biotechnologies, Aptitude Health, BioAscend, Delta Fly, and Takeda. Ms. Welch has received honoraria from Adaptive Biotechnologies and Daiichi Sankyo.

REFERENCES

1. Kantarjian H, Jabbour E, Cortes J: Chronic myeloid leukemia., in Loscalzo J, Kasper D, Longo D, et al (eds): Harrison’s Principles of Internal Medicine, vol 1, pp 818-828. New York, McGraw-Hill, 2022.

2. Jabbour E, Kantarjian H: Chronic myeloid leukemia: 2022 update on diagnosis, therapy, and monitoring. Am J Hematol 97:1236-1256, 2022.

3. Haddad FG, Sasaki K, Issa GC, et al: Treatment-free remission in patients with chronic myeloid leukemia following the discontinuation of tyrosine kinase inhibitors. Am J Hematol 97:856-864, 2022.

4. Sasaki K, Kantarjian HM, Jain P, et al: Conditional survival in patients with chronic myeloid leukemia in chronic phase in the era of tyrosine kinase inhibitors. Cancer 122:238-248, 2016.

5. Experts in Chronic Myeloid Leukemia: The price of drugs for chronic myeloid leukemia is a reflection of the unsustainable prices of cancer drugs: From the perspective of a large group of CML experts. Blood 121:4439-4442, 2013.

6. Kantarjian H, Rajkumar SV: Why are cancer drugs so expensive in the United States, and what are the solutions? Mayo Clin Proc 90:500-504, 2015.

7. Kantarjian H, Zwelling L: Cancer drug prices and the free-market forces. Cancer 119:3903-3905, 2013.

8. Kantarjian H, Steensma D, Sanjuan JR, et al: High cancer drug prices in the United States: Reasons and proposed solutions. J Oncol Pract 10:e208-e211, 2014.

9. Jones GH, Carrier MA, Silver RT, et al: Strategies that delay or prevent the timely availability of affordable generic drugs in the United States. Blood 127:1398-1402, 2016.

10. Chhatwal J, Mathisen M, Kantarjian H: Are high drug prices for hematologic malignancies justified? A critical analysis. Cancer 121:3372-3379, 2015.

11. Kantarjian H, Patel Y: High cancer drug prices 4 years later: Progress and prospects.Cancer 123:1292-1297, 2017.

12. Kantarjian H, Steensma D, Light D: Should oncologists support the Affordable Care Act? Lancet Oncol 14:1258-1259, 2013.

13. Zwelling L, Kantarjian HM: Obamacare: Why should we care? J Oncol Pract 10:12-14, 2014.

14. Kantarjian HM, Steensma DP, Light DW: The Patient Protection and Affordable Care Act: Is it good or bad for oncology? Cancer 120:1600-1603, 2014.

15. Jones GH, Kantarjian H: Health care in the United States: Basic human right or entitlement? Ann Oncol 26:2193-2195, 2015.

16. Kantarjian HM: The Affordable Care Act, or Obamacare, 3 years later: A reality check. Cancer 123:25-28, 2017.

17. Kantarjian H, Light DW, Ho V: The ‘American (cancer) patients first’ plan to reduce drug prices: A critical assessment. Am J Hematol 93:1444-1450, 2018.

18. Kantarjian H, Paul S, Thakkar J, et al: The influence of drug prices, new availability of inexpensive generic imatinib, new approvals, and post-marketing research on the treatment of chronic myeloid leukaemia in the USA. Lancet Haematol 9:e854-e861, 2022.

Disclaimer: This commentary represents the views of the author and may not necessarily reflect the views of ASCO or The ASCO Post.