Joyce Kurisko, MBA

Tim Bartholow, MD

Scott Litow, ASA

According to a recent article published in Cancer Epidemiology, Biomarkers & Prevention, cancer care in the United States exceeded $208 billion in 2020 and is expected to surpass $240 billion by 2030.1 These estimates are driven largely by a growing and aging population. The expenditures also bear witness to a plethora of novel treatments and advanced diagnostics, which have ushered in the age of precision or “personalized” medicine. And it is hitting Medicare hard. Ezekiel J. Emanuel, MD, PhD, in a recent Chasing Cancer Summit, sponsored by The Washington Post, pointed to the financial pressure drug costs are posing on Medicare, citing a 6% increase in just 4 years. The impact of cancer medications is a significant driver.2

Perhaps an inflationary trend of 1.5% per year over 4 to 10 years is acceptable? But at what point are the costs simply too large vis-à-vis the outcomes and demand? Are we getting demonstrable value for the hefty price tag?

Not necessarily. Author and clinician Azra Raza, MD, asserts that almost one-half of patients with cancer are losing their life’s savings chasing treatment regimens that may at best extend overall survival by a mere 2.5 months. At what cost? In her 2019 “memoir,” entitled The First Cell: And the Human Costs of Pursuing Cancer to the Last, she commented: “Since 2005, 70% of approved drugs have shown zero improvement in survival rates, while up to 70% have been actually harmful to patients.” Furthermore, many cancer drugs granted accelerated approval do not complete confirmatory trials to validate safety and clinical efficacy.3

The Price Tag for Success

And yet one cannot argue against the benefits seen with such therapeutics as imatinib, pembrolizumab, or ipilimumab. And cancer outcomes have improved, including a meaningful impact on cancer mortality (down 25%) since 1991.4

However, the price tag for success is high. Imatinib currently costs around $9,000 a month. With little to no generic competition, “dispense as written” equates to an approximate 10% “markup” over the generic equivalent—a drop in the bucket financially speaking.

To no one’s surprise, certain stakeholders are questioning whether measures toward price controls could serve to benefit patients with cancer and the health-care system in general. Indeed, President Biden signed into law this past August the Inflation Reduction Act of 2022, which addresses Medicare’s prohibition from direct negotiation with pharmaceutical manufacturers. Heretofore, the ability of the government to negotiate drug pricing was proscribed. In a typical market, those with significant demand typically exercise substantial leverage in negotiating price.

But price controls and price negotiations are not the same thing.

In 2013, more than 100 experts in chronic myeloid leukemia (CML) opined in the American Society of Hematology publication Blood on the topic of drug prices, particularly imatinib, making the case for the doctrine of justum pretium—or “just price”—and its application to life-saving treatments. The authors asserted: “…When a commodity affects the lives or health of individuals, just pricing should prevail because of moral implications.”5

Categorizing specialty drugs as a commodity may be a stretch, but it does not diminish the role prices can—and should—play in the free exchange of limited resources. Unfortunately, cancer therapeutics do not operate under the same market pressures seen in the commodity market nor a “free market.” The role that intermediaries play in negotiating both price and formulary status is a reality.

A Closer Look at Imatinib

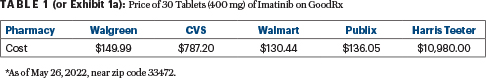

A closer look at imatinib pricing reveals tremendous variability. GoodRx has priced the drug from as low as $130 to more than $10,000 a month (see Exhibit 1a, or Table 1). Whether commercially insured or Medicare recipients, if members are not financially incentivized to reduce their drug spending, they simply won’t. Patients with cancer are likely hitting their maximum out-of-pocket if commercially insured and, therefore, are unlikely to use tools to choose the lowest priced prescriptions.

In the case of imatinib—is it worth a “retail” price tag of approximately $120,000 a year to extend one’s life—potentially turning CML into a chronic condition? Many would argue yes, as do insurers who are willing to pay for such accruements. Is a drug that extends life by a mere 4 weeks worth $50,000? Most would say no, but if an intermediary is willing to pay the cost, there is no economic incentive on behalf of the end-user (ie, the patient) to decline to purchase at the seller’s price. In fact, our health-care delivery model signals to the seller that a willing buyer exists. This behavior assures that the pharmaceutical industry will keep investing in R&D, but it also perpetuates questionable anticompetitive behavior, such as pay-to-delay agreements, and may interfere with the development of inexpensive effective medications, as the means of production are redeployed to more lucrative drug -development.

Misaligned Incentives

Our system is unfortunately burdened with several misaligned incentives when viewing the health-care system holistically. All reform policies to date ignore in part (or in whole) key actuarial, economic, accounting, and medical principles that relate to the viability of the proposal under consideration. These principles include moral hazard, adverse selection, proper risk classification, and actuarial soundness. In general, for cost-conscious members on specialty drugs, antiselection can occur if a health plan offers the lowest cost option due to drug price or formulary/benefits. This may lead to a larger proportion of members on specialty drugs, which if not addressed by increasing cost can quickly send a policy into a death spiral.

Consideration for value creation is a key economic principle applicable to the topic at hand. To put it bluntly, if a drug costs the system $50,000 to extend life by 1 month, quit paying for it. There is arguably no value creation vis-à-vis the limited gain in function. The architecture we operate under is quite scabrous; so too are reform policies that attract political appeal but in essence just kick the proverbial can farther down the road.

Alternate Means of Therapeutic Spending

The concern with price controls is that they are short-sighted. Haven’t we “been there done that” in other industries, with disastrous results? The renowned economist Thomas Sowell has written extensively on this topic, in particular, detailing the perverse downstream effects of rent control.6

Stakeholders should prioritize this reality and “kick the tires” on alternate means of addressing therapeutic spending in lieu of price controls, which, although tempting to consider, may likely lead to more untoward effects. Physicians, patients, and third-party payers all need better analysis of cost-benefit comparisons. Undoubtedly, aggressive price negotiations should be called for in some cases. Perhaps real-world evidence can redefine a drug’s overall worth and value, given its efficacy and toxicity, which can—and should—be reflected in its price.

DISCLOSURE: Ms. Kurisko, Dr. Bartholow, and Mr. Litow reported no conflicts of interest.

Disclaimer: This commentary represents the views of the author and may not necessarily reflect the views of ASCO or The ASCO Post.

REFERENCES

1. Mariotto AB, et al: Cancer Epidemiol Biomarkers Prev 29:1304-1312, 2020.

2. Incollingo BF: Cancer drug pricing debate. Available at http://www.curetoday.com/view/cancer-drug-pricing-debate-reducing-financial-burden-among-patients-and-their-caregivers. Accessed November 16, 2022.

3. Ballreich J, et al: Ann Intern Med 175:938-944, 2022.

4. Heymach J, et al: J Clin Oncol 36:1020-1044, 2018.

5. Experts in Chronic Myeloid Leukemia: Blood 121:4439-4442, 2013.

6. Sowell T: Price controls in Basic Economics: A Common Sense Guide to the Economy, 3rd ed, pp 38-61. New York; Basic Books; 2007.

Ms. Kurisko is an advisor and health policy consultant in Excelsior, Minnesota. Dr. Bartholow is Chief Medical Officer of Venture Advisor and of the Wisconsin Medical Society. Mr. Litow is Actuarial Director for Centene Corporation. Both Dr. Bartholow and Mr. Litow are board members of the Concerned Actuaries of the U.S. (CAUS). Ms. Kurisko serves as an advisor to CAUS.