Hagop Kantarjian, MD

Imatinib mesylate (Gleevec), a Bcr-Abl tyrosine kinase inhibitor, is approved therapy for chronic myeloid leukemia (CML) in the United States. Imatinib is a miraculous drug that results in a normal functional lifespan in most patients with CML who can afford and comply with the treatment and who are monitored optimally.

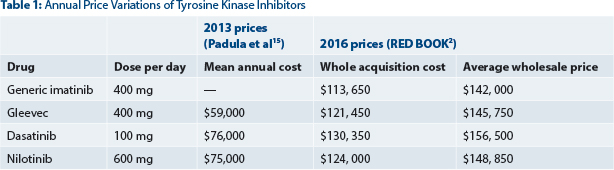

Imatinib was priced at $26,000/year in 2001, a price that considered the population at risk, the cost of research, and profits envisioned for a successful company market strategy. The price was described then as “high but fair” by Daniel Vasella, Chairman and CEO of Novartis.1 The price of imatinib has increased by 10%–20% annually, reaching $132,000/year in 2014 and $146,000/year today (Table 1 below).2 Global sales of patented imatinib were about $4.7 billion in 2015.3

The advent of generic imatinib into the U.S. market educates us on several important points relevant to cancer care today: (1) the high cancer drug prices (previously detailed in several publications)4-6; (2) the importance of generics for patient care and to reduce drug prices; and (3) how well-intended legislations like the Hatch-Waxman Act can be distorted by drug companies to maximize profits.

Importance of Generic Cancer Drugs

High drug prices, particularly for cancer drugs, are the most important health-care concern of Americans today. High drug prices reduce patient access, cause treatment abandonment and financial bankruptcy, and result in severe emotional and family distress.7 The timely availability of affordable generic drugs reduces such concerns. Unfortunately, drug companies have engaged in strategies that delay or prevent the availability of generic drugs. High prices have also “infected” generics, causing significant rises in generic prices in “niche” cancer markets with limited or no competition.

In 1984, the U.S. Congress passed the “Drug Price Competition and Patent Term Restoration Act,” also referred to as the Hatch-Waxman Act.8 The Act outlines the process for generic manufacturers to file an Abbreviated New Drug Application for approval of a generic drug by the U.S. Food and Drug Administration (FDA). The Act provides brand companies patent term extensions not based on patents (eg, FDA approval process time; drugs new active ingredients). To encourage patent challenges and Abbreviated New Drug Application filing, the Act gives the first company to file the first generic Abbreviated New Drug Application 180 days of exclusive U.S. generic market rights. The Hatch-Waxman Act improved the introduction of generics into the U.S. market: Generics accounted for < 20% of U.S. drugs before 1984; today the figure is > 85%.9

Subverting the Hatch-Waxman Act

Unfortunately, the original intent of the Hatch-Waxman Act has been subverted. Nowadays, drug companies take advantage of the complex patent, antitrust, and state laws to develop strategies that extend the lifetime of patented drugs and delay the availability of generics. They include reverse payment (or “pay-for-delay”) patent settlements; authorized generics; product hopping; lobbying against cross-border importation of drugs for personal use; advertising; buying out competitors to establish monopolies in cancer niche markets; and others. These strategies are detailed elsewhere.10

Briefly, pay-for-delay settlements involve the brand company often paying the generic company to delay the first-generic entry into the U.S. market. Authorized generics are drugs produced by brand companies (or in collaboration with other companies) and marketed under a different label at “generic prices.” Brand companies are allowed to produce their own authorized generics during the first-filing generic’s 180-day exclusivity period. The threat of introducing an authorized generic may serve as a bargaining tool: Its introduction as a competitor reduces generic first-filer revenues by 40% to 60% in the subsequent 30-month period.11 As part of the pay-for-delay settlements, brand companies may often promise not to introduce an authorized generic that would compete with true generics. This is a form of market division between the generic company (agreeing to delay market entry, thus prolonging the brand drug monopoly) and the brand company (agreeing not to introduce an authorized generic during the first-generic filing exclusivity period).

The entry of generic imatinib into the U.S. market may illustrate some of these approaches. In a confidential agreement between Novartis and the generic company Sun Pharmaceuticals, generic imatinib was delayed for 6 months beyond the Gleevec patent expiration date, from July 2015 until February 2016. When generic imatinib finally entered the U.S. market in February 2016, it was priced at about $140,000/year2 (Table 1). Generic imatinib is available in Canada for $8,800/year and Gleevec is available for $38,000/year.12 In the United States, Gleevec is priced today at about $146,000/year. Thus, the “generic price” in the United States was in fact not much lower than the branded drug price.

In preparation for the generic imatinib release date in February 2016, Sun Pharmaceuticals had announced it anticipated pricing generic imatinib 30% below the Gleevec price.13 Unfortunately, Sun Pharmaceuticals first-generic imatinib in the United States, enjoying 180-day exclusivity, is priced at a near-patented drug price (not 30% lower as announced; Table 1). Using a combination of reverse payment and perhaps the promise not to introduce an authorized generic, the brand and generic companies secured 12 additional months beyond the patent expiration date during which high prices were imposed—6 months of generic entry delay and 6 months of market “duo-poly.”

Today, health care is globalized, and there are more than 18 generic imatinib versions available worldwide, including 3 in Canada. Generic imatinib is sold at $8,800/year in Canada12 and at about $400/year in India. The cost to manufacture a 1-year supply of 400-mg imatinib tablets is $159.14 Two years from now, the price of generic imatinib in the United States (or purchased from abroad) will be significantly lower, hopefully less than $1,000/year.

Cost-Effectiveness of Generic Imatinib

Anticipating the introduction of generic imatinib into the U.S. market, experts conducted cost-effectiveness analyses of generic imatinib for chronic phase CML therapy. One such analysis compared front-line treatment with generic imatinib vs a physician choice of the three front-line approved patented tyrosine kinase inhibitors (dasatinib [Sprycel], nilotinib [Tasigna], and patented imatinib).15 The authors indicated the primary endpoint of the study to be the 5-year survival (from 2016 until 2021).

The incremental cost-effectiveness ratio (ICER = the ratio of the change in costs to the change in quality-adjusted life-years [QALY] was $883,730/QALY because of the ratio of large differences in the prices of tyrosine kinase inhibitors over small differences in QALY scores.

Simply stated, using a patented tyrosine kinase inhibitor as front-line therapy over generic imatinib would cost about $884,000 per additional year lived (accounting for quality of life)—without a demonstrable improvement in survival. This price is nearly 18 times higher than the acceptable threshold of $50,000/QALY used by most countries to evaluate the cost-benefit of new cancer drugs (United Kingdom, Canada, Australia). Considering 25% to 30% out-of-pocket patient expenses, a price of $50,000 or less for each additional year lived (ignoring quality of life) is the most we can and should pay for a cancer drug in the United States. Otherwise, treatment abandonment by patients would rapidly increase beyond the current 10% to 20%. Also, the prices used in the analysis bear little relation to the “reality on the ground” regarding drug prices today (Table 1).

Potential Solutions

The health-care crisis concerning high patent drug prices is well known and has been extensively discussed. This crisis has spilled over to the area of generic cancer drugs. Strategies to prevent or delay the availability of generic cancer drugs multiply the ill effects of high drug prices. Carving out exclusive cancer niche markets and raising generic drug prices is not an exceptional behavior of a few companies like Turing Pharmaceuticals16 or Valeant.17 Today, it is a common strategy used by drug companies to raise drug prices (both branded and generic) without clear justification.18,19

The delay of generic imatinib in the United States for 6 months after the imatinib patent term expiration, as well as its pricing at near-patented drug prices for the next 6 months, highlights the increasing concerns associated with the delays of affordable generics in the United States.— Hagop Kantarjian, MD

Tweet this quote

The delay of generic imatinib in the United States for 6 months after the imatinib patent term expiration, as well as its pricing at near-patented drug prices for the next 6 months, highlights the increasing concerns associated with the delays of affordable generics in the United States. Solutions to control high patent drug prices have been detailed previously.4-6 Potential solutions specific to generic drugs include: (1) monitor and penalize anticompetitive pay-for-delay strategies; (2) allow the importation of drugs for personal use, which helps when a generic company buys out competitors and establishes a market monopoly that allows price increases to unreasonable levels (eg, Turing Pharmaceuticals and pyrimethamine); (3) monitor potential buyouts that could establish monopolies in small markets; (4) reduce Abbreviated New Drug Application procedures and costs to encourage the presence of multiple generics (rather than few)—This may also prevent or alleviate generic drug shortages; and (5) establish (as is the case in Canada) price boundaries for generics to prevent price gouging (eg, highest first-generic price less than 50% of the patent drug price in the 6-month exclusivity period and less than 20% of the patent drug in general).

Closing Thought

One final thought concerning solutions that may reduce cancer drug prices, both patented and generic. The reasons for high drug prices have been discussed, but a major cause is the combination of oligopolies established by drug companies’ and the lack of transparency in the actual drug prices (eg, average wholesale price vs wholesale acquisition cost vs discounted pricing based on secret negotiations between pharmaceutical companies, health insurance companies, and drug distributors/outlets). Health-care entrepreneurs could develop applications that incorporate, update, and compare drug prices for specialties (eg, 100 to 200 most commonly used drugs in specialties such as cancer, cardiology, etc) in over 200 to 400 outlets in the United States, Canada, India, or other geographic regions.

At present, retail pharmacies do not routinely publish drug prices, and the price of a given drug can vary greatly in the same drugstore chain within the same market. This approach would serve as a source of knowledge for patients, physicians, and insurance companies to compare prices and decide on the source of purchase. Such transparency in availability information—as was done with other applications in other industries (eg, Zagat for restaurants; Hotels.com or Expedia.com for hotels; Kayak.com for multiple travel packages; Consumer Reports.org; Edmunds.com for cars; Rotten Tomatoes for movies)—will help improve market forces and drug pricing. ■

Disclosure: Dr. Kantarjian reported no potential conflicts of interest.

Dr. Kantarjian is Chairman of the Leukemia Department at The University of Texas MD Anderson Cancer Center and a Baker Institute Scholar for Health Policies at Rice University, Houston.

Disclaimer: This commentary represents the views of the author and may not necessarily reflect the views of ASCO.

References

1. Vasella D, Slater R: Magic Cancer Bullet: How a Tiny Orange Pill Is Rewriting Medical History, pp 180-182. New York, Harper Business, 2003.

2. RED BOOK, Truven Health Analytic: A Comprehensive, Consistent Drug Pricing Resource. Available at http://micromedex.com/products/product-suites/clinical-knowledge/redbook. Accessed May 3, 2016.

3. Novartis Q4 and FY 2015 Condensed Financial Report (January 2016): Novartis International AG. Available at https://www.novartis.com/investors/financial-data/product-sales. Accessed May 3, 2016.

4. Kantarjian H, Steensma D, Rius Sanjuan J, et al: High cancer drug prices in the United States: Reasons and proposed solutions. J Oncol Pract 10:e208-e211, 2014.

5. Tefferi A, Kantarjian H, Rajkumar SV, et al: In support of a patient-driven initiative and petition to lower the high price of cancer drugs. Mayo Clin Proc 90:996-1000, 2015.

6. Howard DH, Bach PB, Berndt ER, et al: Pricing in the market for anticancer drugs. J Econ Perspect 29:139-162, 2015.

7. Collins SR, Rasmussen PW, Doty MM, Beutel S: The rise in health care coverage and affordability since health reform took effect: Findings from the Commonwealth Fund Biennial Health Insurance Survey, 2014. Issue Brief (Commonw Fund) 2:1-16, 2015.

9. Generic Pharmaceutical Association: Generic Drug Savings in the U.S. Seventh Annual Edition: 2015. Available at http://www.gphaonline.org/media/wysiwyg/PDF/GPhA_Savings_Report_2015.pdf. Accessed May 3, 2016.

10. Jones GH, Carrier MA, Silver RT, Kantarjian H: Strategies that delay or prevent the timely availability of affordable generic drugs in the United States. Blood 127:1398-1402, 2016.

11. Federal Trade Commission: Authorized Generic Drugs: Short-Term Effects and Long-Term Impact (August 2011). Available at http://www.ftc.gov/sites/default/files/documents/reports/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission/authorized-generic-drugs-short-term-effects-and-long-term-impact-report-federal-trade-commission.pdf. Accessed May 3, 2016.

12. Kantarjian H, Mathisen MS, Lipton JH: Having “skin in the game” and allowing cross-border importation of drugs to lower high prices of cancer drugs. JAMA Oncol 1:729-730, 2015.

13. Sun hopes cut-price generic Gleevec will win third of U.S. market (February 1, 2016). Available at http://www.businessinsider.com/r-sun-hopes-cut-price-generic-gleevec-will-win-third-of-us-market-2016-2. Accessed May 3, 2016.

14. Cancer Drug Mark-Ups: Year of Gleevec Costs $159 To Make But Sells for $106K (September 25, 2015). Available at http://commonhealth.wbur.org/2015/09cancer-drug-cost. Accessed May 3, 2016.

15. Padula WV, Larson RA, Dusetzina SB, et al: Cost-effectiveness of tyrosine kinase inhibitor treatment strategies for chronic myeloid leukemia in chronic phase after generic entry of imatinib in the United States. J Natl Cancer Inst 108:djw003, 2016.

17. Pollack A, Tavernise S: A drug company’s price tactics pinch insurers and consumers. The New York Times, Section A1, October 5, 2015.

18. Morgenson, G: Side effects of hijacking drug prices. The New York Times, Section BU, October 4, 2015.

19. Beasley D: Pfizer hikes U.S. prices for over 100 drugs on January 1. Reuters, Business Section. January 8, 2016. Available at http://www.reuters.com/article/us-pfizer-prices-idUSKBN0UM2FU20160109. Accessed May 3, 2016.